When you think of the bail industry, you’re likely to think of bail agents and their bounty hunters, who chase down fugitives released on bail for a fee, sometimes employing questionable tactics. But the true profiteers of the United States’ distinctive cash-bail system are insurance brokers, the little-known surety companies that underwrite bail bonds and often collect much of the profits.

An ongoing legal battle in California is exposing the immense power and influence of these bail surety companies, which stand accused of conspiring to keep bail bond premiums at artificially inflated rates to boost profits. If true, this means people are being fleeced trying to get themselves or a loved one out of jail — if they’re able to afford the exorbitant prices at all.

The lawsuit details how for years, the surety lobby allegedly retaliated against bail bondsmen who defected from the price-fixing scheme. According to court records, insurance executives and bail bondsmen colluded to keep bail prices sky-high at industry gatherings at resorts and in Las Vegas casinos and spread misinformation to consumers about bail rates.

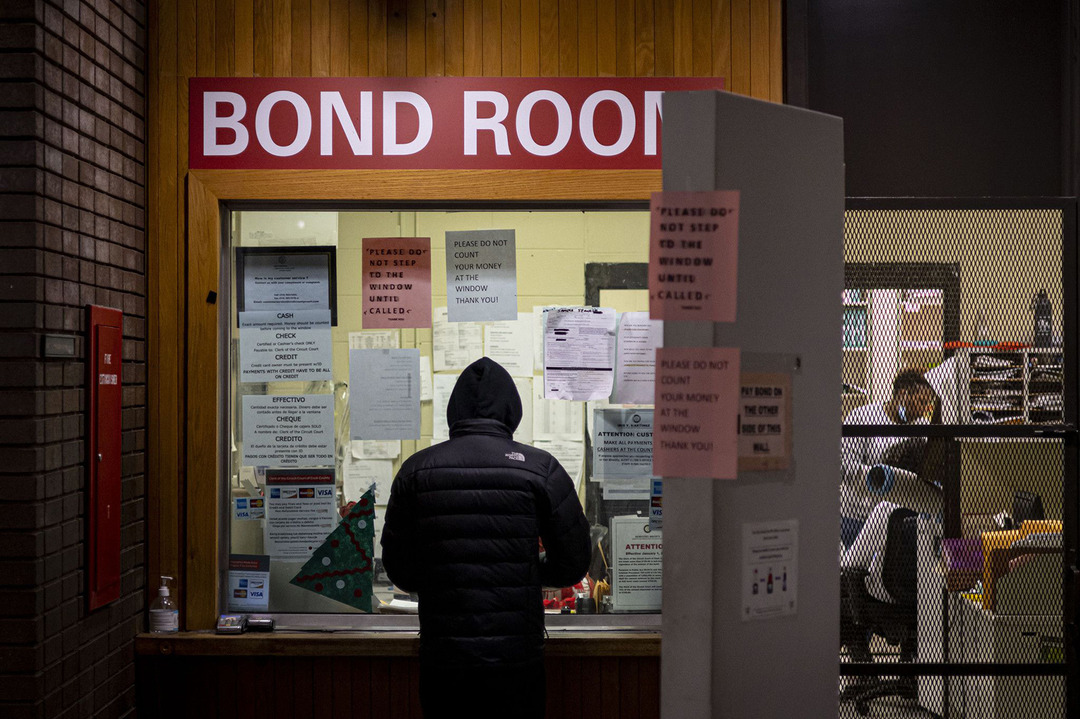

As a result, bail bond buyers — people held on bail and their families — in California alone have likely overpaid by more than $2 billion over the last two decades, according to an estimate by an antitrust expert in the case. The higher prices, too, have likely made it more difficult for people to get out of jail before trial, which can cause long-lasting harm. Even a few days in jail can upend people’s lives, leading to lost jobs, lost housing, or unstable family care.

In 2019, two women in California brought the antitrust case against twenty surety companies in the commercial bail business, which account for the…

Auteur: Katya Schwenk