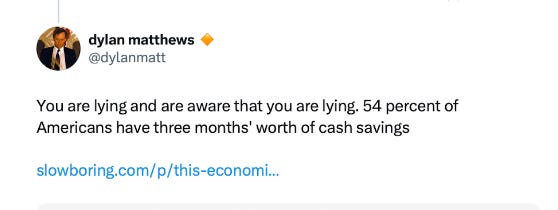

Bernie Sanders says it over and over again: 60% of Americans live paycheck to paycheck. But Matt Darling of the Niskanen Center swears it’s not true and Dylan Matthews of Vox calls it a damned lie. Even Matt Yglesias is apparently on the case, but I’m blocked from seeing his posts.

Who’s right and who’s wrong? Who should we listen to? Bernie Sanders — a model citizen of our community? Or the infamous Vox-Niskanen syndicate?

The answer is that Bernie is right. In the 2019 Survey of Consumer Finances (SCF), conducted triennially by the Federal Reserve, the median working-age (25–64) household, excluding active business owners, reported its “normal income” as $73,175 per annum, and had $4,521 in transaction balances, such as checking or savings accounts. (All amounts are in 2022 dollars.)

That’s about 3.2 weeks’ worth of income in cash. If “living paycheck to paycheck” means having less than a month’s worth of income saved in cash, then calculated in this way, the “60%” factoid gets it exactly right: the share of working-age, non-business-owning households living paycheck to paycheck was:

- 63% in 1998

- 63% in 2001

- 64% in 2004

- 64% in 2007

- 67% in 2010

- 64% in 2013

- 61% in 2016

- 59% in 2019

In other words, Bernie nailed it.

What led the above-cited pundits to the erroneous conclusion that it was Bernie who erred?

The most important factor, quantitatively speaking, is slightly technical and takes a bit of explanation. If you want to use household wealth data to determine what share of Americans “live paycheck to paycheck,” you have to exclude business owners from the analysis. This isn’t just because — to state what should be obvious — business owners can’t “live paycheck to paycheck,” no matter how poor they are, since they don’t receive a paycheck.

The more important point is that including business owners in the data distorts the analysis quantitatively. Business-owning households typically…

Auteur: Seth Ackerman